- Mother's Maiden Name

- Date of Birth

- Social Security Number

- Account / Card Number

- Username

- Password

- E-Mail Address

- One-Time Passcodes

An account takeover happens when a fraudster poses as a financial institution to get your personal or account information. Once the fraudster has access to your account, they can make unauthorized transactions.

How Does It Work?

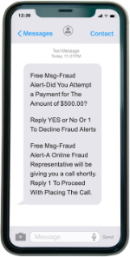

An account takeover usually begins with a fraudster sending a text message to your mobile phone claiming they‘re from a financial institution‘s fraud department. They ask you to confirm a suspicious payment that was sent from your account — this may not be true and could be part of the fraud.

An account takeover usually begins with a fraudster sending a text message to your mobile phone claiming they‘re from a financial institution‘s fraud department. They ask you to confirm a suspicious payment that was sent from your account — this may not be true and could be part of the fraud.

If this is a fraud attack, the fraudster typically follows up with a phone call and asks for your personal information to “cancel the payment.”

NOTE: Peoples State Bank employees will not call you and ask for your personal information over the phone.

The account takeover fraud usually begins on a Friday, after business hours, and runs through the weekend.

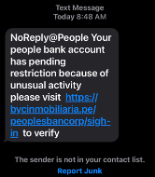

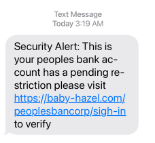

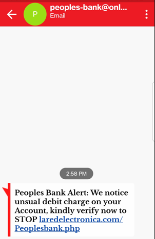

The phone shows an example of a fraudulent “account takeover” text message.

How Can You Prevent Account Takeover Fraud?

If someone posing as a Peoples State Bank employee contacts you by phone, email, or text message and wants you to share your personal information, consider it fraud.

If you receive a text (or email) like the one shown here, do not reply to the sender. Ignore the message and do not call any phone numbers listed in the text.

If you receive a phone call that seems to be a phishing attempt, end the call immediately. And be aware that area codes can be misleading: a local area code does not always guarantee that the caller is local.

If you feel that you have been the victim of fraud, contact your local banking OFFICE.

AVOID FRAUD: Do not share your personal information with anyone posing as our institution.

Online Security tips

|

Choose a Unique Password & Update it Frequently |

|

Be sure it is not the same password to your other accounts |

|

Avoid Personal Information |

|

Don’t use names, initials or birth dates in passwords |

|

Be Aware of Your Location |

|

Try to avoid logging on at hotels, coffee shops, airports or anywhere that doesn't use secure wireless networks |

- Secure your device with a password and use the built-in security functions such as auto-lock, face recognition/ fingerprint login, and remote wipe.

- When you have finished using the banking app, log out and close the app completely.

- Keep your devices up-to-date by staying current on device, carrier, operating system and application updates. (Older operating systems may prevent the mobile app from working at all.)

- If your device is stolen or lost, contact the bank to have your device's access disabled. It's also recommended to change your online banking username and/or password.

- Use caution when connecting to public Wi-Fi hotspots. Avoid conducting mobile banking or any financial transactions over a public Wi-Fi network whenever possible. If possible, use your carriers' data connection or a VPN for any data you wish to keep private.

- Block unwanted calls and text messages. Take steps to block unwanted calls and to filter unwanted text messages. There are several apps available for your mobile device.

- Don’t give your personal or financial information in response to a request that you didn’t expect. Legitimate organizations won’t call, email, or text to ask for your personal information, like your Social Security, bank account, or credit card numbers. Never call a number they gave you or the number from your caller ID.

- Don't be pressured to act immediately. Often scammers will place a sense of urgency that something bad will happen if you don't act right away. Anyone who pressures you to pay or give them your personal information is a scammer.

- Know how scammers tell you to pay. Never deposit or cash a check and send money back to someone, especially if they insist you pay with a gift card or by using a money transfer service.

- Stop and talk to someone you trust. Before you do anything else, tell someone what's happening. It could be a friend, a family member, a neighbor, or your local banking officer. We're here to help. Talking about it could help you realize it’s a scam.

- If your debit card is lost or stolen, please contact the bank immediately at 740-342-5111.

- Outside of regular business hours, please call 888-297-3416 to report your card lost or stolen.

- Never write your PIN on the back of your card or where your card is kept.

- Shield the ATM keypad when entering your PIN to prevent others from viewing your PIN.