Cyber Security Awareness Month 2024 Is Officially Here!

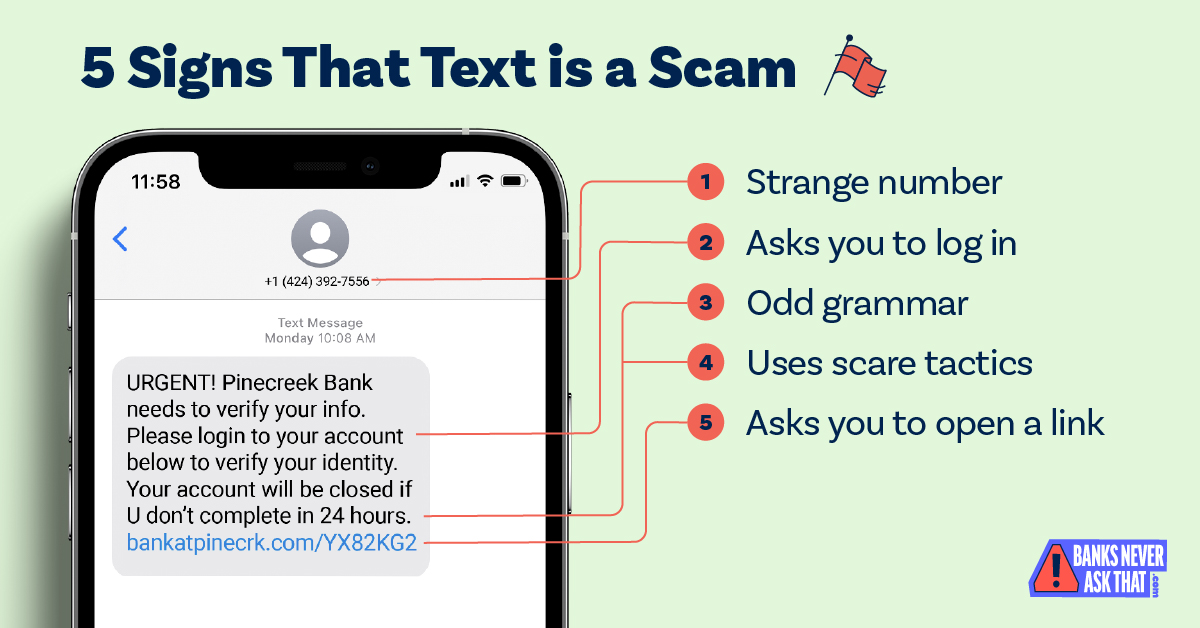

We are continuing our awareness campaigns and want every bank customer to become a pro at spotting a phishing scam—and stop bank impostors in their tracks. It starts with these four words: Banks Never Ask That. Because when you know what sounds suspicious, you’ll be less likely to be fooled. Below are just some of the tips on how to keep phishing criminals at bay. For more information, including videos, an interactive quiz and more, visit www.BanksNeverAskThat.com.

This year's campaign also includes the Practice Safe Checks campaign that provides information on how to keep your checking account information safer when using checks. For more information about safer check writing, visit www.PracticeSafeChecks.com.

We will continue to periodically post on our social media sites on Facebook and Instagram throughout the year with awareness reminders (like the banner items above). Remember, we are here to help! If you have questions, please call or stop by any of our office locations and speak to one of our employees. Additional resources about specific types of scams are also available at the FTC scams website.

- Does the email have a generic/impersonal greeting such as "Dear Customer"?

- Is the email requesting you to provide personal information, account details, or other information that the bank should already have access to?

- Does the email have 'urgent' or threatening statements, such as "Your account will be locked", in an effort to get you to click on a link or call a phone number?

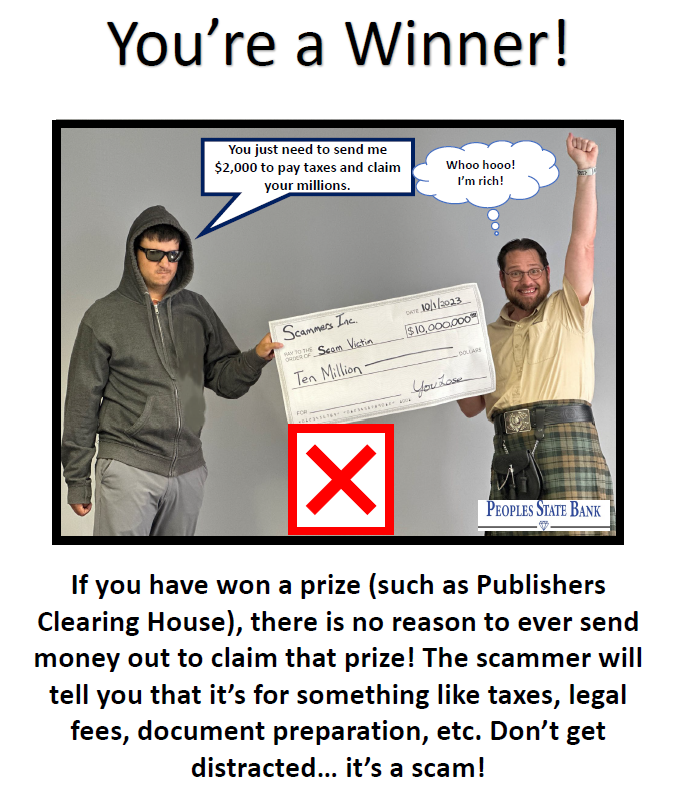

- Does the email suggest that you will receive some form of large payment, but requires you to send money to them first?

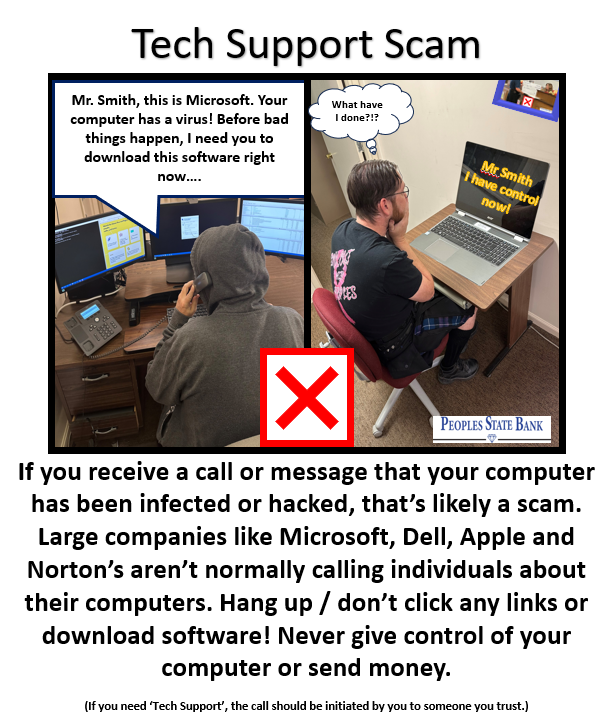

- Keep your software up to date on your phone and computer.

- Use anti-virus, anti-malware, activate firewalls and other security software.

- Utilize spam blockers/filters on email clients and cell phones.

- Protect account logins with multi-factor authentication whenever available.

- Back up important data frequently on an external drive or the cloud.